I'm Back, With My NGCOA Articles and Technology Web Casts

Hello everyone,

Well, I've been negligent in not posting to my own blog the articles I write for NGCOA and the technology webcasts I do as well. That all changes today, Aug. 16, 2023.

Here is my latest Golf Business Weekly article about how Stanford researchers used AI to track traffic to 3400 US golf courses and determined that Wednesday afternoons at 4 PM were the busiest time of the week, other than Saturday mornings. It' results from the Work From Home change that started during COVID and is ongoing. So if you are still discounting those weekday afternoon tee times, think again if you should discount at all. You're likely leaving lots of money on the table:

Here is the full report: How Working From Home Boosted Golf

249

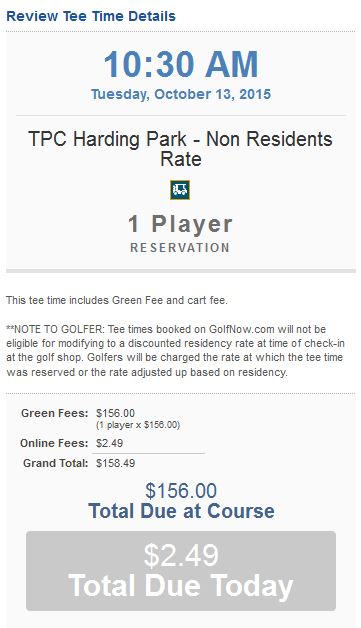

How is it that, in both party's presidential debates, the key economic issue of income disparity is front and center, yet we have millions of golfers throwing away $2.49 (or more) just to reserve a tee time. The assumption is that our wonderful country is much wealthier than our politicos want you to believe. Either that, or all of the golfers tossing their $2.49+ into the void are all part of the 1%.

Two issues are at play here. First, American consumers are some of the dumbest on earth. How else can we explain how GolfNow has reserved over 13 million rounds (in 2014) at $2.49 each. Add EZLinks' 3-4 million rounds on TeeOff.com, and the tab adds up to about $50 million. Just imagine if that $50 million was back in the pockets of golf course owners. To quote Sam Cooke, "What a wonderful world this would be."

This takes us to the second issue - golf course owners and operators have allowed this to happen. They are to blame, for not effectively marketing that they have online tee times that cost nothing, ZERO, to reserve. Let's do a quick math exercise. You won't need a calculator to follow along.

Let's say our golf course, OMG Springs, has 2000 rounds a year booked through GolfNow. Take that 2000 times $2.49, and GolfNow takes nearly $5000 to the Comcast bank. How might OMG Springs have benefitted if those 2000 golfers had that $5000 to spend at the course, rather than throwing it away for something they just as easily could have done on the robust OMG Springs web site? That's a lot of beer and hot dogs, or range balls, or more rounds of golf. With that $5 grand, OMG Springs could have bought that one GolfBoard they so badly coveted.

It doesn't have to be this way. The effort needed to own your customers is not monumental. If you need help, call me. Otherwise, on those sleepless nights when counting sheep doesn't work, try imagining $2.49 flowing into your cash drawer, one drop at a time. Maybe, just maybe, you'll wake up to reality.

Don't let this be you:

Welcome To Our Blog

Welcome to our blog. Check back soon for updates!